My partner and I spent the week around Christmas in Mumbai, India. Mumbai is the financial and economic centre of India. The Bombay Stock Exchange (BSE) had a splendid year behind with a year output of more than 33%.

From local newspapers a moderate hosanna mood can be felt. Also internationally India got much attention in the last year. It is particularly the growing middle class that forms the driving force behind the economy and which gets attention of foreign investors.

With an increase of 33% the BSE is one of the best performing markets in the world. Of course it must immediately be said that almost all markets performed very well. The phenomenon that markets are moving more or less in the same direction is called correlation.

Correlation between markets is high: data which I have collected on 15 minutes basis of the futures on the FDAX and the DOW JONES appear to have a correlation of more than 90% over the past 2 years. This is almost complete correlation.

Now the question arises if a result such as that of the Bombay Stock Exchange can be attributed to well performing of the Indian economy

or that also chance may play a role in it. It cannot be denied that chance and luck play an important role on the markets.

Let’s have a look at this without going into this matter to deeply. Suppose that an invisible hand would assign the different markets worldwide a return around a certain average. Then you may expect these returns to be divided normally.

A quick lookup at the

financial site of Yahoo reveals the following. Of the 17 most important markets there is not one with a negative output over 2006. The output diverges from 10% (London) up to 55% (Moscow) with an average of rounded 24%. The spread, standard deviation amounts to 23%. This means that if the 17 markets are representative for all markets in the world, about 66% of all markets will show an output of 1 standard deviation above or below the average (therefore 24% ± 23%). Of all 17 markets there are only 2 outside this range.

We can look at this also in a different way: we can consider the return of an individual market

as an estimate of the world average and look at how well such an estimate would be.

It is known that such an estimate will have a standard error that equals to

σ/√T where

σ is the annual volatility and

T the number of years:

STD = σ/√T (1)

From formula (1) it follows that the standard error of an estimate of the world average decreases with the square root of the number of years.

Let’s take Mumbai as an example. The excess return or

α, of this market above the world average is 33-24 = 9%. Though in general the term

α refers to the excess return of a fund with respect to the benchmark, it may also be used for the excess return of a market.

To be convinced that an excess return is the consequence of a better performing of the economy and not

to pure chance or luck then the return must be bigger than the world average with a significant size. In a one-sided test at the 95% confidence level the difference between the two must be greater than 1.65 standard deviations.

Suppose the volatility to be around 20% on an annual basis for the Bombay market then the standard error according to (1) will be 20%/√1 = 20%. The 9% above the average of the market is clearly smaller than one standard deviation above the average, clearly below 95% confidence level. It lies approximately at 50% what means that 50% of the return of Bombay falls to pure chance. In fact you can say that the 33% return of Mumbai is a good estimate of the world average.

We can carry out this calculation also differently and perhaps it will even become more clearly then. We saw that the standard error of an estimate of the average decreases with the square root of the number of years taken into account.

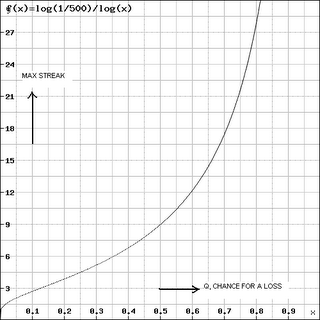

We know that: α =9% = 1,65* STD. It follows that STD, the standard error, equals 9/1,65 = 5,45. This value substituted for the STD in formula (1) gives √T = 23% /5,45 = 4.22 ==> T = 17,8 year.

This means therefore that the Bombay Stock Exchange

for at least 17 years in succession must show a return that 9% or more lies above the world average to be able to say that for 95% this is due to a better performing of the economy and only for 5% to chance.

Around these days various funds present their performances. Some will show better results than others. From the previous it must be clear that luck may play a large role besides skill of the fund managers and in any case is much larger than they will admit. Think to that.