MARKET UPDATE AND PREDICTABILITY

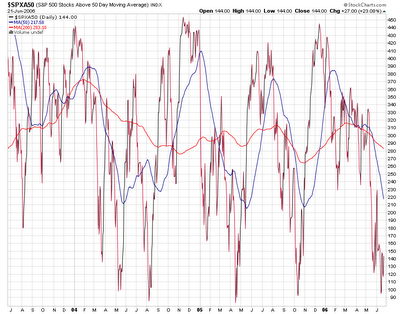

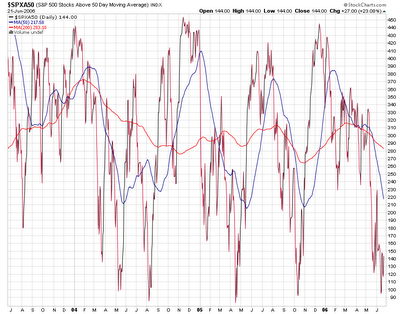

The markets in a decline at the moment, we can recognise that off course. If we look at stocks moving above 200 and 50 day moving average (symbols: $SPXA200 and $SPXA50), we can see that both are moving at the bottoms of recent years, see charts below.

If we are not too bearish about the current markets, and why would we? we may expect a recovery or at at least a sideways movement from here.

In Business week I found an interesting article about the predictability of market prices. I was posting earlier about it. If you think markets are moving in a random way, as some theoreticists postulate, it has no use to try finding a way getting more from the markets than the average benchmark (such as an indexfund) does.

I earlier summed up some opposite opinions about this view. Make up your mind. I agree with this writer when he says:

The first thing you need to do is convince yourself that the markets are not completely random. If the markets are completely random, no amount of research, emotional detachment, etc. will help. To continue to trade when you know the markets are random is to engage in gambling. Do you think that winning traders over a period of years gamble? I've been to Las Vegas many times and never put even a quarter in a slot machine.

Once you convince yourself the markets are not completely random, your search will take on new meaning. The challenge then becomes how do I locate non-random opportunities in the market so that I can exploit them?

From: Elitetrader Forum

If we are not too bearish about the current markets, and why would we? we may expect a recovery or at at least a sideways movement from here.

In Business week I found an interesting article about the predictability of market prices. I was posting earlier about it. If you think markets are moving in a random way, as some theoreticists postulate, it has no use to try finding a way getting more from the markets than the average benchmark (such as an indexfund) does.

I earlier summed up some opposite opinions about this view. Make up your mind. I agree with this writer when he says:

The first thing you need to do is convince yourself that the markets are not completely random. If the markets are completely random, no amount of research, emotional detachment, etc. will help. To continue to trade when you know the markets are random is to engage in gambling. Do you think that winning traders over a period of years gamble? I've been to Las Vegas many times and never put even a quarter in a slot machine.

Once you convince yourself the markets are not completely random, your search will take on new meaning. The challenge then becomes how do I locate non-random opportunities in the market so that I can exploit them?

From: Elitetrader Forum

SYSTEMTRADING | |

| DOW JONES | SUBSCRIBE THIS FEED |

0 Comments:

Post a Comment

<< Home