TRADES AND MARKET MOVEMENTS

After a couple of days I was finally able today to place some orders on the FDAX and on the DOW future.

What was the reason for not trading? Well, the market did not came up with my favourable setups but just trended upwards very strongly, every position would be unsecure. We have to see if the market wil revearse from here for a more longer time or just a blow off after FED's decision and suggestions about further interest rates.

Joao and fernando of Hello Dax, a blog on which I am invited to write something about futures, propose a setup for a winning option strategy on the DAX. I have some doubts about this.

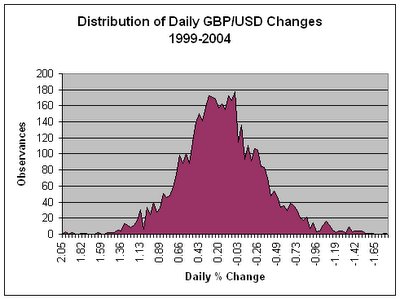

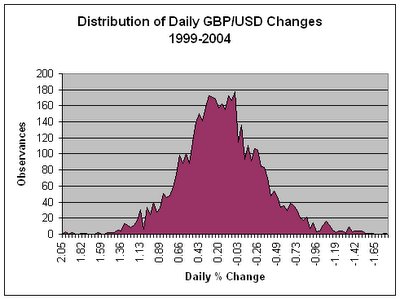

Movements on markets are not linear as they suppose to assume but rather random walks, certainly in the short and middle long time span. Markets move in a jagged fashion which may be demonstrated by comparing distributions of returns over various time periods. Just look at the graphs below.

The fact that the range of the 5-day distribution is nowhere near five times the width of the 1-day distribution (in terms of max to min) tells you the market

almost never moves directly from point A to point B. Off course this is a valuta index but you may expect this being the case for stock indices too. Options are very susceptiable for such movements.

Dow Jones

FDAX

Systemtrading

What was the reason for not trading? Well, the market did not came up with my favourable setups but just trended upwards very strongly, every position would be unsecure. We have to see if the market wil revearse from here for a more longer time or just a blow off after FED's decision and suggestions about further interest rates.

Joao and fernando of Hello Dax, a blog on which I am invited to write something about futures, propose a setup for a winning option strategy on the DAX. I have some doubts about this.

Movements on markets are not linear as they suppose to assume but rather random walks, certainly in the short and middle long time span. Markets move in a jagged fashion which may be demonstrated by comparing distributions of returns over various time periods. Just look at the graphs below.

The fact that the range of the 5-day distribution is nowhere near five times the width of the 1-day distribution (in terms of max to min) tells you the market

almost never moves directly from point A to point B. Off course this is a valuta index but you may expect this being the case for stock indices too. Options are very susceptiable for such movements.

Dow Jones

FDAX

Systemtrading